News

10 July 2017

Farm Africa pilots the use of microinsurance to help pastoralists

In the face of an increasingly uncertain climate, Farm Africa is piloting the use of microinsurance to help pastoralists in the Ethiopian lowlands protect their main asset: their livestock.

The aim is to help vulnerable communities in drought-prone areas in the Afar and Somali regions, and North and South Omo zones respond to climate shocks in ways that contribute to their recovery, rather than weaken them further.

Two different models of drought insurance are currently being trialled:

Model A is indemnity insurance linked to microfinance. Customers take out loans to purchase cattle that includes insurances against the loss of their animals due to disease, theft, accidents etc.

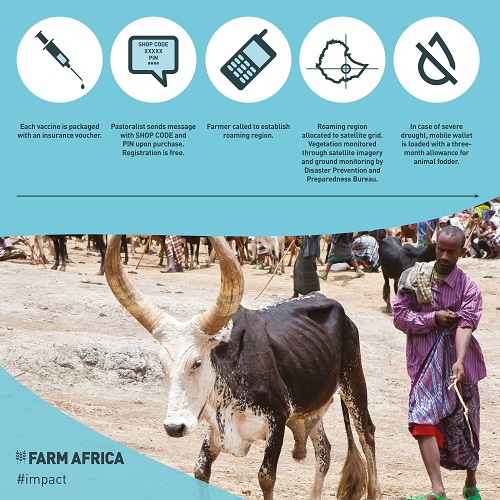

Model B (illustrated in the graphic below) offers pastoral asset protection. Customers of veterinary supply retailers buying animal vaccines pay a small additional margin to buy a contract that triggers a payout if there is localised drought.

Farm Africa is working on the insurance products with leading Ethiopian insurance company Nyala Insurance, the NGO Mercy Corps and consultancy firm Pula Advisers

The initiative is part of the MAR project, which is part of the Building Resilience and Adaptation to Climate Extremes and Disasters (BRACED) programme funded by the UK’s Department for International Development.

Many pastoralists’ traditional coping mechanisms, such as intra-clan redistribution of livestock, are not working any more. The trend in the value of herds is upwards due to a stronger livestock value chain. However, herd sizes and profitability can vary hugely in response to the availability of pasture and poorly functioning markets. Many people therefore fluctuate between periods of relative wealth and periods of asset poverty, making their situation suitable for some form of insurance.

We are piloting livestock microinsurance for a number of reasons:

- When faced with impending catastrophe, access to insurance can help people make appropriate investment decisions that do not compromise their long-term resilience.

- If the scheme reaches scale, good rains in one area can cancel out losses from drought elsewhere, and there’s a potential business case.

- The availability of insurance could potentially stimulate investment into the livestock economy in vulnerable areas.

- Microinsurance is another way to help address financial inclusion among the vulnerable, alongside mobile banking and other schemes.

- Although subsidies may be needed initially, this is preferable to and cheaper than large-scale humanitarian response.